IRS Announces 2018 Contribution Limits…

Every year in or around October, Uncle Sam releases cost of living adjustments for retirement account contributions. This year because of the talk about the new tax bill, there was some concern in the financial community about whether or not deferral rates would be lowered.

But here’s the kicker. Congress gives us these tax breaks to encourage retirement savings, but lowering the deferral rates would do just the opposite. Lowering the deferral rates would be a big blow to the average American trying to save for their retirement by contributing to their company 401k. I had the honor of meeting with Senator Bob Corker’s staff to express concern over these proposed changes. Thankfully, the powers that be saw the light and those reductions didn’t happen.

So What Changed For 2018? Here Are the Highlights…

401(k)

Employees who choose to participate in their company’s 401(k), 403(b) and 457 plans will be allowed to contribute up to $18,500 in 2018. That’s a bump of $500 from 2017.

401(k) and 457 Plan Catch-Up

The catch-up contribution limit for employees who are 50 or older in these plans holds steady at $6,000 for 2018.

The limit on the annual benefit for those participating in a defined benefit plan goes up $5,000 to $220,000 in 2018.

Defined Contribution Plans

Total annual contributions (annual additions) to all of your accounts in plans maintained by one employer (and any related employer) are capped at $55,000 for 2018 creeping up just $1,000 from 2017.

Remember that Uncle Sam also limits the amount of your compensation that can be considered when determining employer and employee contributions to $275,000 in 2018. That’s up $5,000 from in 2017.

Income Caps

The income caps for Highly Compensated Employees and Key Employee (Officers) remain the same at $120,000 and $175,000. And, the base taxable wage for Social Security gets a small bump to $128,700 for 2018.

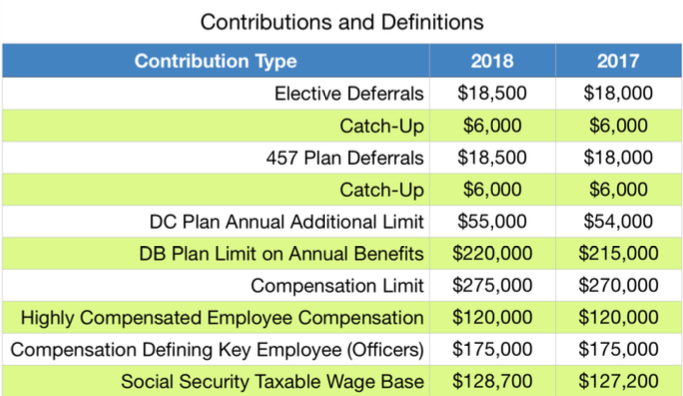

Need all this info in one easy-to-read chart? Your friendly neighborhood TPA has you covered. Check it out below.

Remember it’ retirement we’re talking about. The more you know and understand, the better off you will be.

Best Regards,

President

MBA, QKA, CBC